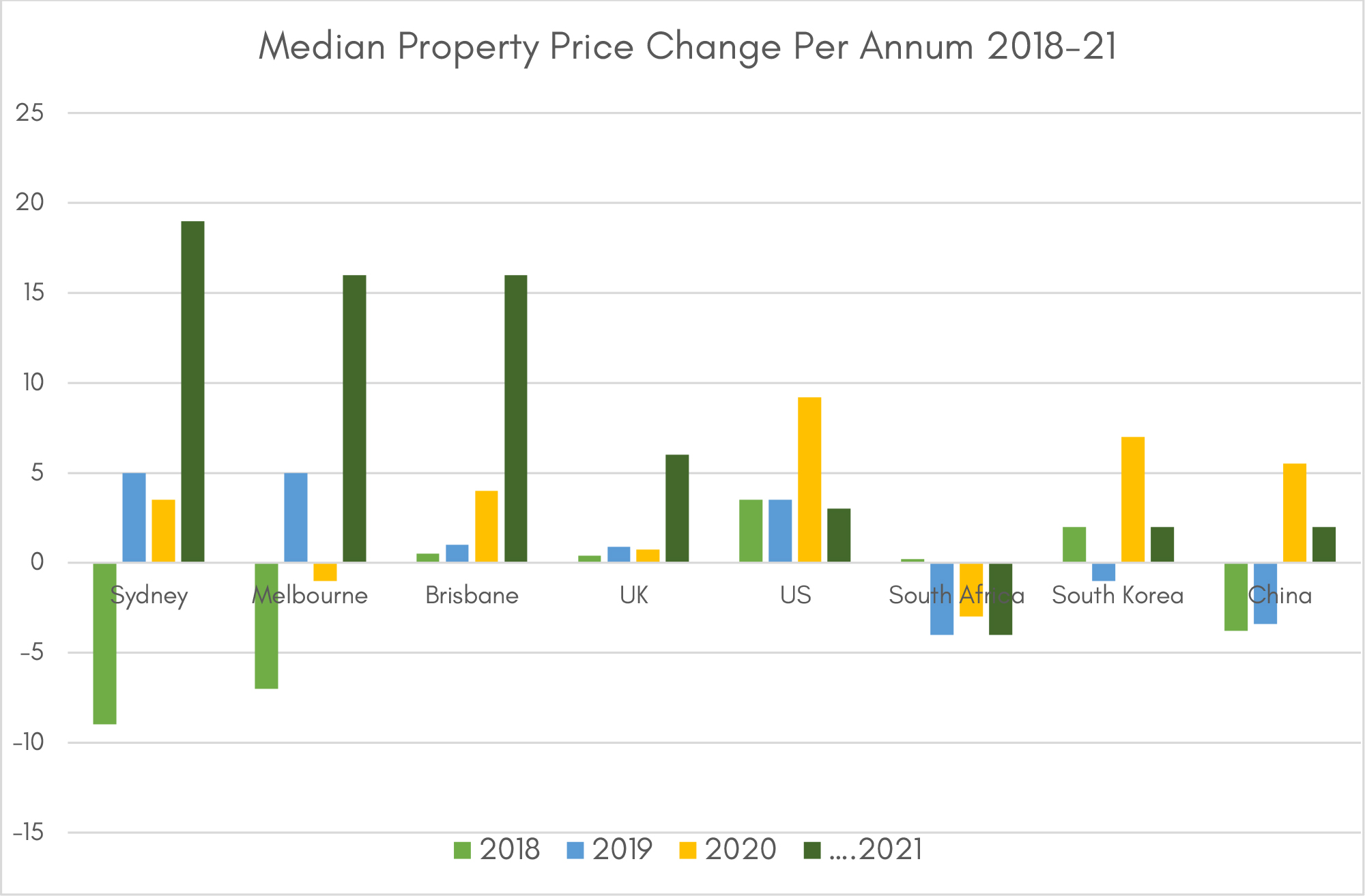

Whilst Peak Growth in the Australian market was in March 2021, property prices for 2nd hand homes, Land and Medium Density property has continued to surge and in 2021 prices have increased 17.6%.

It’s not new, we had this growth in 1988-9. What happened in the years following was a significant property correction in Australia and recovery from that bust took between 4 and 8 years to recover.

Price increases may be a silver lining for those who own homes, it is not for those that are trying to enter the market. First Home Buyer owner occupier loans dropped over 20% between January and July 2021. They are priced out, what is the use?

As detailed in my last video, affordability is now becoming a big issue for many and the relief it appears will not come from raising rates, but from APRA’s hands possibly reducing the ability for investors to keep buying.

The ability for those buyers to purchase in a Sustainable and Livable Community is also an issue.

The evidence is in. Price stability will come from greater First Home participation. If you allow those who are in the market to continue to buy, and we don’t see a larger number of listings on the market then the trajectory on prices will likely continue. Good for some but not sustainable. Policy makers now must find the balance sooner rather than later.

Jason Salter Livable Communities.